Going to college is an exciting experience – until you start to talk about the financial obligations it can require. When it comes to paying for a college degree, knowing the fundamentals and making wise choices can mean the difference between a life of debt or a life of financial freedom.

In this two part series on student loans, you’ll gain the information you need to make the best decisions both as a student requesting the loans and as a graduate repaying the debt.

In this article specifically, you’ll learn about the components and terminology of student loans as well at the type of loans available. It’s important to note this article is primarily focused on students pursuing an undergraduate degree as opposed to those in a graduate or doctorate program.

Loan Components

Every loan, whether student, personal, or car has three key components:

- Principal – the initial amount of money borrowed

- Interest – the cost of borrowing; usually expressed as an annual percentage rate (APR). It is a percentage that is consistently added to the principal

- Term – the length of time it will take to repay the combined total of principal and interest owed

Student Loan Components

Student loans include these three components but also have a few that are more specific, including:

- Grace Period – the time between receiving the funds/cash from a loan and the time the first payment is due. This period is often given automatically to all borrowers. For example, a lot of federal loans provide six months after graduation before your first payment’s due date.

- Deferment – similar to a grace period, this is a period of time between receiving the funds and making the first payment. The difference is it usually comes with a stipulation or condition, the most common of which is attending/returning to school as a full time student.

- Forbearance – another time when no payments are due, however it is due to “economic hardship” or financial distress. You need to work specifically with the lender to see if and how this option can be applied.

- Capitalized – many student loans start accruing (adding) interest as soon as you receive the money. That interest is capitalized when the lender adds all of that interest to the principal (often times at the end of one of the time periods mentioned above). This results in you owing more money because interest is a percentage of the principal and adding more to the principal means adding more in interest as well.

Now that you understand a bit of student loan lingo, you’re ready to learn about the types of student loans available and how these different components are represented in each

Student Loan Types

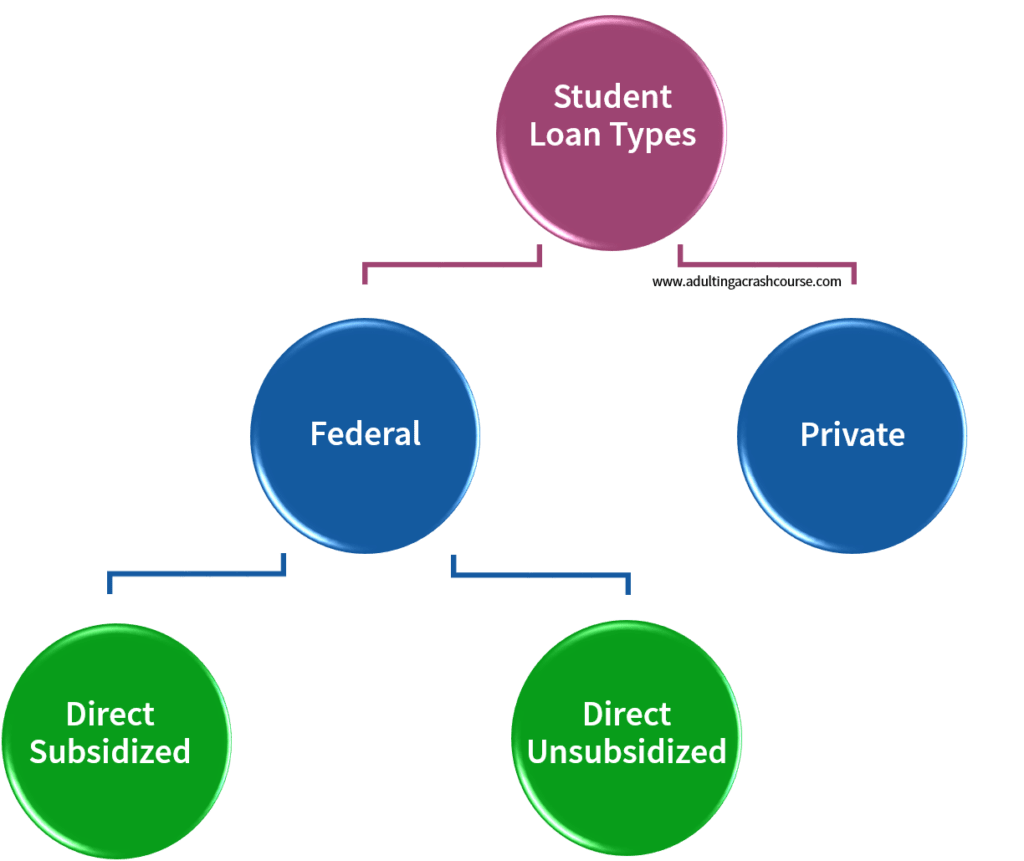

There are two main categories of student loans: federal and private

Federal Loans

Also known as public loans, these are loans funded by the government. For undergraduates, there are two classes available. Both classes accrue interest as soon as you receive the funds, but who pays that interest is the key difference.

Direct Subsidized – a subsidized loan is one where someone else (in this case, the federal government) is paying the interest on your loan during the grace and/or deferment period. The amount you can borrow is based on your financial need, which is determined annually when you complete the FAFSA.

Direct Unsubsidized – an unsubsidized loan’s interest is paid by the borrower/student. You do not need to demonstrate financial need to qualify.

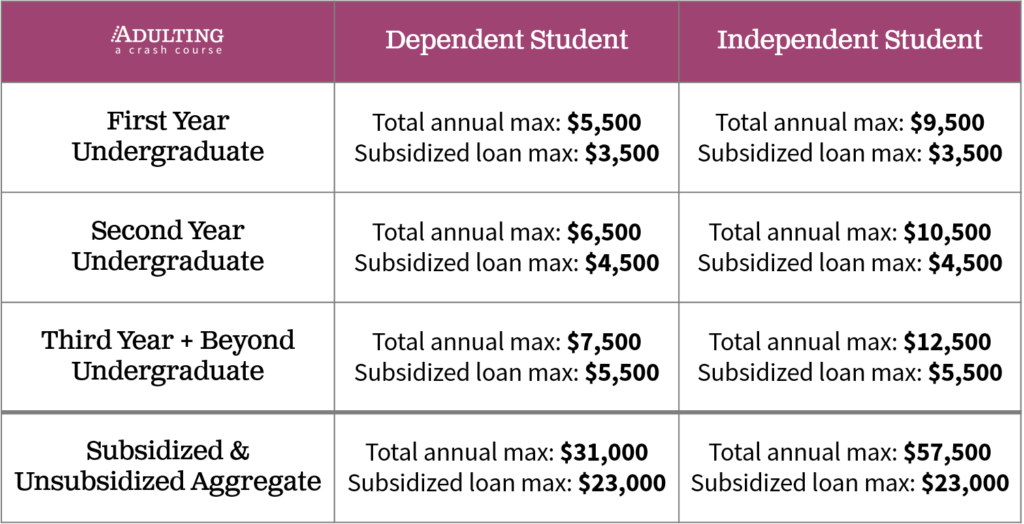

Federal Loan: Borrowing Limits

Both federal loan types come with limits for each year of your education, as well as an overall (aggregate) maximum. Theses maximums vary based on how you complete the FAFSA. If you use your parents’ tax forms, you are a dependent student. If you use your own tax forms, you are an independent student. Below is a chart of the limits for the two student types.

Private Loans

These are loans you receive from banks, credit unions and other institutions. Make sure to read the paperwork carefully on these loans as many factors can vary from one to the next including:

- grace period

- deferment/forbearance options

- variable versus fixed interest rates

- repayment term/timeline

- when and how interest accrues

- capitalization

In Conclusion

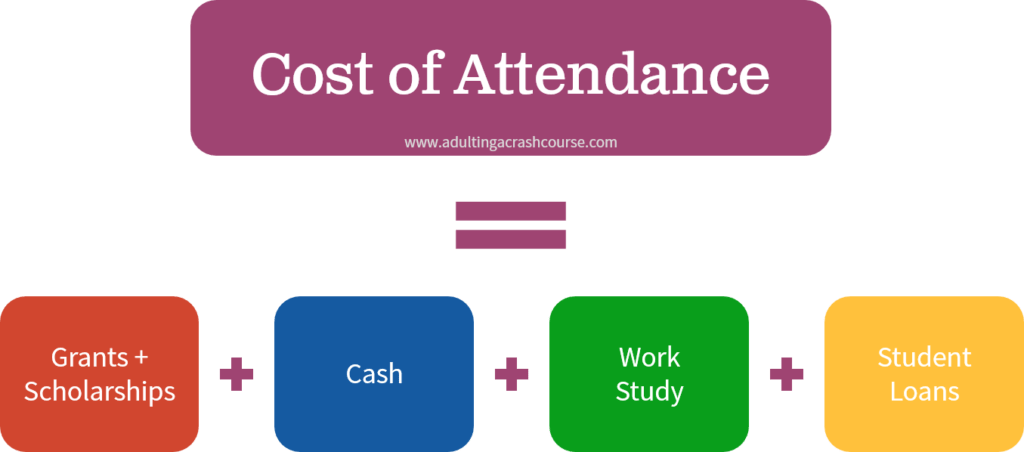

With all of this in mind, the ideal combination of loans looks like the below:

Keep this ranking in mind as you consider your financing options. Interest rates and subsidies are key factors in determining how much you will ultimately pay for your degree. Note this also does include other sources of financing, such as scholarships, grants and cash.

What’s next? Check out the second article in this series, How to Repay Your Student Loans Faster.

If you liked this article, you may also like

Adulting, Made Easy.

Our online courses help you take the steps to be your happiest, most successful self at home and at work.